In order to make an accurate judgment, you have to know well first.For those of you who were looking for a deposit loan in the shopping district

I’m sure you all know the power of cash in modern society, but surprisingly, some people ignore the importance of economic and financial information. If you decide to receive financial products, you need to think about whether to borrow cash from the financial sector by looking at the international situation and interest rate growth, rather than using the funds you can withdraw first. Therefore, in this article, I would like to talk about the common sense of finance that needs to be understood and point out the loan products that can be used in the environment where each person is located.

It’s a good tip to be proactive when you study one by one.For those of you who are looking into commercial deposit loans

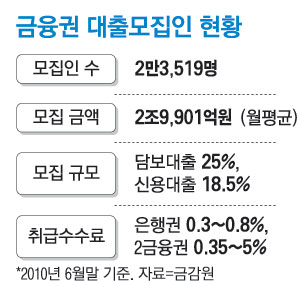

Since all products and preferential benefits are different depending on the bank, we will explain more detailed know-how step by step on the next opportunity, and this time we will only mention basic differences. First of all, in the case of the first financial sector such as Nonghyup Bank, Korea Development Bank, and Kakao Bank, interest rates are low because they can be used safely, but for example, the loan limit is around 80% of annual income, 780 credit points, and the universal interest rate is 5.91%. Second finance, such as savings banks, securities firms, and credit card companies, has a usage limit of more than 105%, which is approved more easily, but the interest rate exceeds 13.75%. Therefore, if you have to take out a loan and have good credit conditions, it would be more useful from a distance, but if you need a lot of money with more than 3 loans or 445 credit points in repayment, it is advantageous to visit Second Finance.

I’m going to talk about deposit loans in the easy-to-use loan product shopping district

However, there are supportive products for those who have difficulty in general loans or are not good enough cash and have high credit scores, but they are often approved at low interest rates for low-credit people such as Hessal Loan and Hessal Loan Youth. These products can be repaid within 3-5 years at a low interest rate of 9.10%, and even if the credit rating is not good, they can be used easily, so various people use them when the situation is not good.Let me tell you about investments and mortgages that can further increase returns.Recently, financial technology that can use large amounts of money has continued to diversify and the recognition of the financial technology market has increased, but in the case of real estate loans, there is a 40% difference in LTV between regions such as non-adjustment, adjustment, and speculation. However, since the limit is measured in the transaction price of the target, the increase in sales prices and variable interest rates should be carefully considered. In addition, there is a way to prepare about 15 million won using loans and jump into the stock investment market to earn profits exceeding 4.5% interest rates, but due to economic conditions, there is a risk rate, so it should be thoroughly considered and used efficiently.Please refer to the latest information on deposit loans in shopping districts for one hour at a timeAs loan inquiries increase, it is easy to increase assets by using loan products in a wise process in a modern society that focuses on capital formation and investment. However, if you approach danger with greed, you may rather fail, so you have to choose the appropriate product considering the purpose of use, and if you use it wisely, you have to use it advantageously as it is 5.51% cheaper, 350,000 won cheaper per month. I’ve talked about the benefits and products of the common people with high utilization so far, and I hope you find them when you have to prepare a lot of money and receive them efficiently.Previous image Next imagePrevious image Next imagePrevious image Next imagehttps://www.youtube.com/shorts/GkTDUyAdUqU